This helps prevent budget overruns and provides greater transparency in financial planning. One of the key benefits of encumbrance accounting is enhanced financial management. By reserving funds for future liabilities, such as payroll and taxes, organizations can ensure that they have encumbrance accounting the necessary funds available when needed. This allows for better expenditure control and prevents overspending, ultimately leading to improved financial stability. Encumbrances and actual expenses are two critical components in the realm of financial management and accounting.

- Both are essential for maintaining financial transparency and effective financial decision-making within an organization.

- It’s then automatically sent to the department head and anyone else who must approve the purchase based on the approval workflow rules and thresholds that have been set up in the Planergy system.

- The lender, generally a bank, retains an interest in the title to a house until the mortgage is paid off.

- From the setup of a more precise budget amount to avoiding red spending flags, encumbrance accounting can help your company have more accurate and helpful general book sets.

- Verify purchase order transactions so you can see what encumbrances materialized into actual paid expenses.

This encourages transparency and increased visibility in how the budget is being allocated and how money is being spent. As a result, organizations can track their expenditures against the allocated budget more effectively. Encumbrance accounting involves recording encumbrances in the general ledger when the organization is certain about the time and amount of the anticipated expense. This is done before creating and collecting the underlying documents, such as purchase requisitions and purchase orders. Encumbrance accounting is often used as a planning tool for budgetary control, particularly in government organizations using government accounting standards and nonprofits.

Definition and Example of an Encumbrance

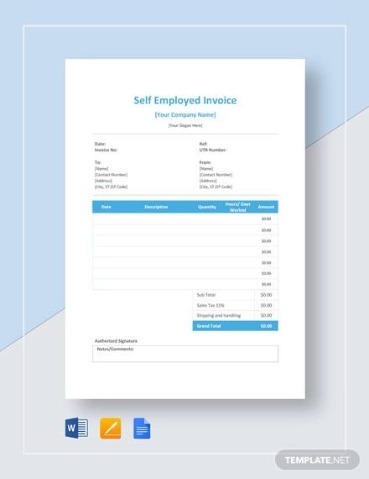

Integrated systems can automate data flow between different modules, reducing the risk of errors and providing a seamless user experience. Next, organizations need to choose the appropriate encumbrance accounting system. There are various software options available that can streamline the process and improve accuracy. These systems enable efficient encumbrance tracking, generating reports and providing real-time insights into encumbrance balances and activity. The primary purpose of encumbrance accounting is to ensure that funds are set aside in advance for anticipated expenses, contracts, or commitments.

- In some cases, businesses may enter into a large contract or have debt or loan repayment that results in restricted cash balances held aside for specific purpose expenditures.

- Public Sector organizations use Encumbrance Reports to get an exact picture of their monthly and YTD encumbrances.

- Using encumbrance entries can serve as a general planning tool and can predict cash outflow.

- An easement occurs when the property owner retains title to the land, but another entity also has the right to use the land for a specific reason.

- There is a structure involved in encumbrance accounting that organizations can use to manage their financial commitments and ensure that funds are allocated, obligations are met, and expenses are accurately recorded.

In some cases, the property can be repossessed by a creditor or seized by a government. When you decide to carry cover encumbrances, check that all journal entries are correctly made and that all the balances you’re bringing forward are correct, since the balances you bring forward cannot be reversed. In this document, the IT department can list the equipment they want to purchase and the vendor they intend to use. It’s then automatically sent to the department head and anyone else who must approve the purchase based on the approval workflow rules and thresholds that have been set up in the Planergy system. The External Encumbrance (balance type code EX) refers to the commitment of funds generated by purchase orders. Encumbrance entries are primarily recorded to monitor expenditures and to ensure that the allocated budget is not exceeded.

Overview of Budgetary Control and Encumbrance Accounting

In accounting, an encumbrance is an open commitment to pay for goods or services ahead of the actual purchase. In other words, the purchasing company makes a promise to pay before the expense is incurred. Encumbrances are also known as pre-expenditures since they act as budgeted reserve funds before the actual expenditure.

California Budget Lists Millions for IT as Deadline Looms – Government Technology

California Budget Lists Millions for IT as Deadline Looms.

Posted: Wed, 14 Jun 2023 07:00:00 GMT [source]

In Hong Kong, for example, the seller of a property is legally required to inform the real estate agent about any encumbrances against the property in order to avoid any problems later on in the sales process. The real estate agent will provide the buyer with a land search document that will have a list of any encumbrances. The term encumbrance covers a wide range of financial and non-financial claims on a property by parties other than the title-holder. Property owners may be encumbered some from exercising full—that is, unencumbered—control over their property.

Grant & Contract Accounting

Routable provides a complete audit trail to help lower fraud and compliance risk and helps increase visibility through this thorough tracking. We also allow you to process your invoices and payments your way, whether that means email, scanning, or automatically forwarding bills from your email. Routable wants to enable you to grow into the future, which is why we have a sophisticated API for any bulk processing.

While encumbrances are financial reservations made in advance to allocate funds for future expenses, actual expenses represent costs incurred when transactions are actually executed. Encumbrances are a preventive tool to ensure responsible budgetary management, while expenses provide a retrospective view of financial transactions. With how essential an accurate fund balance is, there are many ways accounting teams have tried to track this data.

This money during this phase has been requested, but not yet approved for the purchase. Then, when that request is approved, a purchase order can easily be made for the exact amounts. When the encumbrance amount gets added to the general ledger, you can remove the payment from the pre-encumbrance amount.

However, agencies/departments must meet the deadlines for submitting procurement documents as specified by the DGS. We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy. A restrictive covenant is an agreement that a seller writes into a buyer’s deed of property to restrict how the buyer may use that property. There might be a provision that requires the buyer to leave a building’s original facade intact, for example. As long as they do not break the law, restrictive covenants can be as specific and arbitrary as the parties are willing to agree to.

What is an example of an encumbrance?

By monitoring encumbrances and analyzing their balances and activity, companies can gain insights into upcoming expenses and better manage their cash flow. This is especially valuable for long-term financial planning and decision-making. By tracking encumbrances, companies can more accurately allocate funds, ensuring that budgets are adhered to and that resources are used efficiently.

- This systematic approach helps organizations effectively manage their budgets, comply with regulations, and maintain financial transparency.

- However, agencies/departments must meet the deadlines for submitting procurement documents as specified by the DGS.

- In Hong Kong, for example, the seller of a property is legally required to inform the real estate agent about any encumbrances against the property in order to avoid any problems later on in the sales process.

- These encumbrances can be tracked manually or automatically through specialized systems like Oracle General Ledger.

- By monitoring encumbrances and analyzing their balances and activity, companies can gain insights into upcoming expenses and better manage their cash flow.

- A restrictive covenant is an agreement that a seller writes into a buyer’s deed of property to restrict how the buyer may use that property.