This result is interpreted as the organization saved $15,000 in direct materials costs by using less direct material per unit than they planned. It is important to remember that standards are the planned or projected amounts. It could mean that the direct materials quantity standard needs to be reduced to achieve an accurate standard variable cost per unit. Or, further investigation might reveal a production error in which the units were improperly sized, which is a significant quality control issue. The total variances can be calculated in the last line of the top section of the template by subtracting the actual amounts from the standard amounts. The standard quantity allowed of 630,000 feet is subtracted from the actual quantity purchased and used of 600,000 feet, yielding a variance of 30,000 feet.

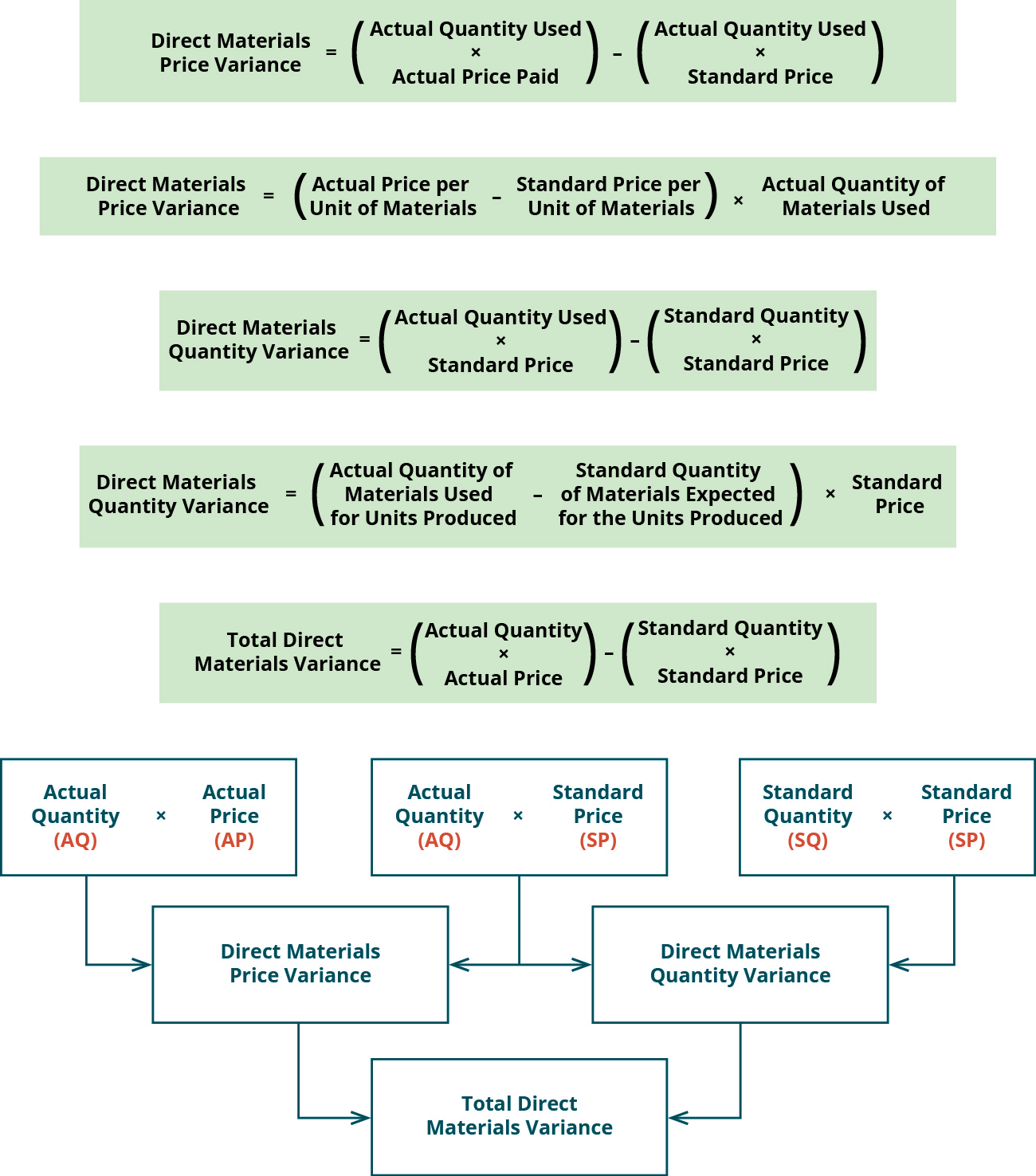

What is the formula to calculate material variances?

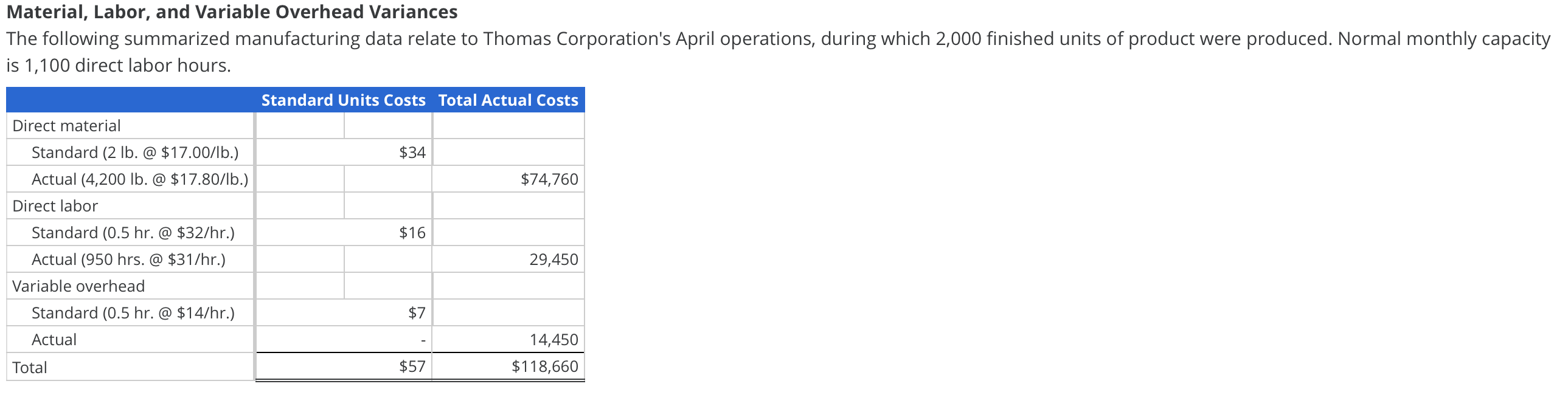

The total direct labor variance is separated into the direct labor efficiency and direct labor rate variances. As shown in Exbibit 8-1, Brad projects that the standard variable cost to make one unit of product is $7.35. He estimates that each unit should require 4.2 feet of flat nylon cord that costs $0.50 per foot for total direct material costs per unit of $2.10. Each unit should require 0.25 direct labor hours to assemble at an average rate of $18 per hour for total direct labor costs of $4.50 per unit. Variable manufacturing overhead costs are applied to the product based on direct labor hours.

Equipment Maintenance – Best Practices for Addressing Efficiency Variance

- Offering incentives for employees who demonstrate a commitment to efficiency and quality can help to motivate them to continue to improve.

- Third-party providers may have more expertise in navigating regulatory requirements and ensuring compliance than the company does in-house.

- The actual price of $0.55 per unit is not given in the actual data presented in Exhibit 8-1.

- Additionally, we have explored when a company should consider investing in new equipment, outsourcing certain processes, and how to ensure that employees are adequately trained to minimize efficiency variance.

- This can occur when quality standards are not correctly defined or lack monitoring and enforcement.

- Determine whether a variance is favorable or unfavorable by reliance on reason or logic.

This amount will represent the expected expenditure on direct material for this many units. The difference between this actual expenditure and the actual expenditure on direct material is the direct materials price variance. Generally, the production managers are considered responsible for direct materials quantity variance because they are the persons responsible for keeping a check on excessive usage of production inputs. However, purchase managers may purchase low quality, substandard or otherwise unfit materials with an intention to improve direct materials price variance. In such cases, the responsibility of any unfavorable quantity variance would lie on the purchasing department. Irrespective of who appears to be responsible at first glance, the variance should be brought to the attention of concerned managers for quick and timely remedial actions.

Cost Accountant – Who Is Responsible for Monitoring and Analyzing Efficiency Variance

Let us assume further that during given period, 100 widgets were manufactured, using 212 kg of unobtainium which cost € 13,144. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. basics of estimated taxes for individuals Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

This account often contains the standard cost of the direct materials on hand. A manufacturer must disclose in its financial statements the actual cost of materials on hand as well as its actual cost of work-in-process and finished goods. Connie’s Candy paid \(\$2.00\) per pound more for materials than expected and used \(0.25\) pounds more of materials than expected to make one box of candy.

That inefficiency will likely cause additional variable manufacturing overhead which will result in an unfavorable variable manufacturing overhead efficiency variance. If the inefficiencies are significant, the company might not be able to produce enough good output to absorb the planned fixed manufacturing overhead costs. This in turn can also cause an unfavorable fixed manufacturing overhead volume variance. The standard price of materials purchased by Angro is $2.00 per kg and standard quantity of materials allowed to produce a unit of product is 1.5kg. During December 2020, 5,000 units were produced using 8,000kgs of direct materials. Calculate direct materials quantity variance and also indicate whether it is favorable or unfavorable.

If an inevitable process is only needed during certain seasons or intermittently, it may not be cost-effective for a company to invest the necessary resources to perform it in-house. Poor communication between departments or individuals can result in delays, mistakes, and reduced efficiency. This can occur when information is not shared correctly or when there is a lack of clarity regarding roles and responsibilities.

Equipment breakdowns can cause production delays, reducing efficiency and increasing costs. The breakdown of a single piece of equipment can cause a domino effect, leading to delays in other parts of the process. This can result in increased labor costs, wasted materials, and missed deadlines. Labor efficiency variance measures the difference between the actual number of labor hours used to produce a given quantity of goods or services and the number of hours budgeted for that same quantity. In addition to improving profitability and efficiency, monitoring efficiency variance can help companies stay competitive. By optimizing their operations and reducing costs, companies can offer their products or services at more competitive prices, which can help them to attract and retain customers.

If competitors use more advanced equipment, investing in new equipment may be necessary to remain competitive. It is essential to foster a culture of collaboration and open communication among all employees. Predictive maintenance is a technique that uses data from sensors and other devices to predict when equipment is likely to fail. By identifying potential problems before they occur, manufacturers can take proactive measures to prevent breakdowns, reduce downtime, and improve efficiency. This can occur when the layout of a facility or the sequence of tasks in a process is not optimized for efficiency. When a company experiences a significant efficiency variance, it may need to take action to address the issue and optimize its operations.