.png)

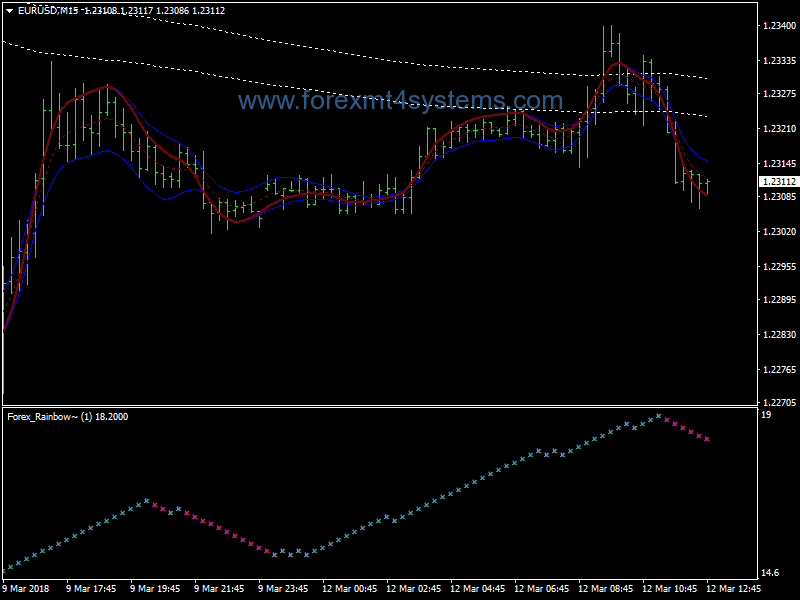

However, this is not unique to death crosses, but is true for any investment or trading strategy. The best way of mitigating false signals is to add additional filters such as the ADX, MACD or RSI. If you’re an investor, the death cross can provide a visual tool and a warning signal to brace for an implementing breakdown and downtrend. Couple the death cross moving average pattern with an inverted yield curve for a stronger signal.

.jpeg)

Conclusion: The death cross pattern

- For example, the index declined by 16%, and some investors used it to analyze long-term trends.

- Following an extended bullish phase, the index showed signs of faltering, paving the way for the death cross.

- One common variation of the death signal is a 20-day moving average downside cross of the 50-day moving average.

- The most closely watched stock-market moving averages are the 50-day and the 200-day.

A death cross in trading is the term used to describe the point at which a short-term (50-day) moving average drops below a longer-term (200-day) moving average. The time frames used can be shorter or longer, but the 50-day and 200-day averages are commonly used. However, to actively trade around the death cross as an event, you should study how your stock, crypto, or other asset has performed shortly after a death cross. For example, you may find that the more oversold an asset is when the death cross happens, the more chance you have of a reversal rally. If this is the case, look for bullish candlestick patterns and oversold conditions to confirm your long strategy.

Similarly, considering the lagging nature of this indicator, traders must remember that a Death Cross confirms a bearish trend that has already happened, rather than predicting future market movements. Understanding the Death Cross requires a solid grasp of moving averages—a key concept in the field of technical analysis. The two types of moving averages central to this concept are the Simple Moving Average (SMA) and the Exponential lexatrade review Moving Average (EMA). Additionally, the S&P 500 formed a death cross in December 2007, just before the global economic meltdown, and in 1929 before the Wall Street crash that led to the Great Depression.

Role of the Bearish Signal

No, the Death Cross should not be the sole determinant of investment decisions. It is important to incorporate other technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and volume indicators for a comprehensive analysis. These additional indicators provide further confirmation and insights into market trends. However, it’s important to note that low timeframes, like 20 or 5-minute bars, will produce much less accurate signals than daily bars. Knowing this, traders should try to employ other indicators and filters to filter false death cross signals.

These two opposing trends influence the buy and sell decisions of stock market traders who rely on technical indicators. The death cross is generally seen as a fairly reliable signal for potential market downturns, especially when considering long-term moving averages. Its effectiveness, though, can vary with different market conditions and shouldn’t be the sole factor in decision-making.

In finance, stock chart patterns help traders predict the future price movement of a stock or index. However, there is another approach; investors consider it a signal to buy the stock at a low price and average their investments. In the ever-evolving fxbrew forex review – a good broker or scam landscape of financial markets, the Death Cross stands as a noteworthy indicator, signaling potential shifts in market dynamics. While it carries significance, it’s imperative to approach it with a comprehensive analysis framework.

While the Death Cross signals an impending bear market, the Golden Cross suggests a bull market may be on the horizon. Both of these indicators signal significant market trend shifts and can prompt investors to adjust their strategies accordingly. One of the main criticisms of the Death Cross is its susceptibility to false signals. This often occurs due to market noise—short-term fluctuations that can cause the 50-day moving average to dip below the 200-day moving average temporarily before bouncing back. A rising 200-day moving average suggests a long-term bullish trend, while a falling 200-day moving average points to a long-term bearish trend. While a bearish signal, the pattern is often a better indication of a short-term market slump or price correction than the emergence of a bear market or recession.

Keep Your Eyes on the Price 🏆

The pivotal moment – the actual death cross – happens when these two averages intersect, with the short-term average falling below the long-term one. Central to the death cross is the meeting of a short-term moving average with its long-term counterpart, trending downwards. Typically, this occurs when the 50-day moving average, a short-term trend indicator, dips below the 200-day moving average, a marker of the longer-term market direction. This event is telling – it implies that current market attitudes are deteriorating faster than long-term views, hinting at a prolonged downward trend. The above variations may work more effectively when there is a particularly wide separation between the 50- and 200-day moving averages.

A death cross is when a short-term moving average crosses under a long-term falling moving average, signaling a reversion of the trend. Investors and traders use the death cross to understand when the market is likely to go from bullish to bearish. The technical interpretation of a death cross is that the short-term trend and Forex trading plan the long-term trend have shifted. Therefore, traders and investors expect the new trend to begin a bearish market phase.

It took them 11 hours and they had expected to be picked up by someone once in the US. Since the Patel tragedy, at least two more families have died trying to unlawfully cross the US-Canada border. A family with two children had been with the other migrants as they made their way across the border at night, border agents were told, but they had become separated. Nearly three years after an Indian family of four froze to death in Canada during an ill-fated attempt to enter the US, two men are facing trial, accused of trying to help smuggle them across the border. More than 14,000 Indian migrants were arrested at the Canadian border while attempting to cross into the U.S. illegally, in the year that ended on Sept. 30. Prosecutors said Patel, who was also known as “Dirty Harry,” organized the scheme and Patel was the driver.

The Death Cross may lead to a sustained downtrend in the asset’s price, confirming the bearish signal and indicating a prolonged period of declining prices. Investing and trading are complex activities that require a good understanding of financial markets. While indicators like the Death Cross can provide valuable insights, they are not foolproof. Other technical indicators, such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and volume indicators, should also be considered for a comprehensive analysis.