For example, data from previous years will tell you the optimum times to order beachwear or Christmas-themed items. It is important for all teams who wish to successfully implement JIT understand that the approach is not without risks. Because buffers are being removed or decreased (less work-in-process stock, short customer delivery cycles, etc.), any problem that arises can become quite consequential. The company as a whole must be well versed in the JIT philosophy and embrace an operational excellence mindset. Just-in-time inventory models allow businesses to minimise the quantity of things stored in their warehouses or perhaps remove the need for warehouses completely, reducing costs and increasing efficiency.

Which of these is most important for your financial advisor to have?

Master manuscripts of books are kept on hand, but texts are only printed and assembled as needed when a retail sale is made. Apple’s chief executive officer (CEO) Tim Cook parlayed the 16 years of supply management experience he gained working at IBM and Compaq Computers to entirely revamp Apple’s manufacturing process. Starting as Apple’s chief operating officer (COO) in 1998, Cook pulled the company out of manufacturing, closing Apple’s warehouses and factories around the world.

Kanban 101 for Manufacturing

Because the firm designs and manufactures up to 50% of its range in mid-season, it can react fast to new trends and get items into stores before the bandwagon rolls on. When it comes to scheduling, there is no assurance that a firm will always be able to get the cheapest pricing from a supplier for raw materials. It is important to note that these activities have an impact on the business and the supply chain. Because producers do not have to pay to store their goods, just-in-time manufacturing technologies help to reduce inventory expenses.

What is the purpose of the JIT inventory system?

The goal would then be to time your production rates and forecast demand so you receive your replenishment order just in time to avoid a stockout. Following this pattern on an ongoing basis ensures you don’t have to store more components than you actually need. Contrary to JIT’s methodology of keeping inventory to a bare minimum, just-in-case (JIC) inventory prioritizes being prepared to fulfill any request at any time, with a very short fulfillment timeframe. Companies that offer services such as next-day shipping are likely using JIC practices.

How Does Just-in-Time Inventory Work?

Cook’s supply chain improvements reduced the amount of time Apple’s inventory sat on the company’s balance sheet, which went from months to days. To have the best chance of success with just-in-time, it’s critical that companies find suppliers that are either located close by or can supply materials quickly and with little advanced notice. It’s also important that these suppliers waive any minimum order requirements that could hurt smaller businesses, which typically purchase smaller quantities of materials.

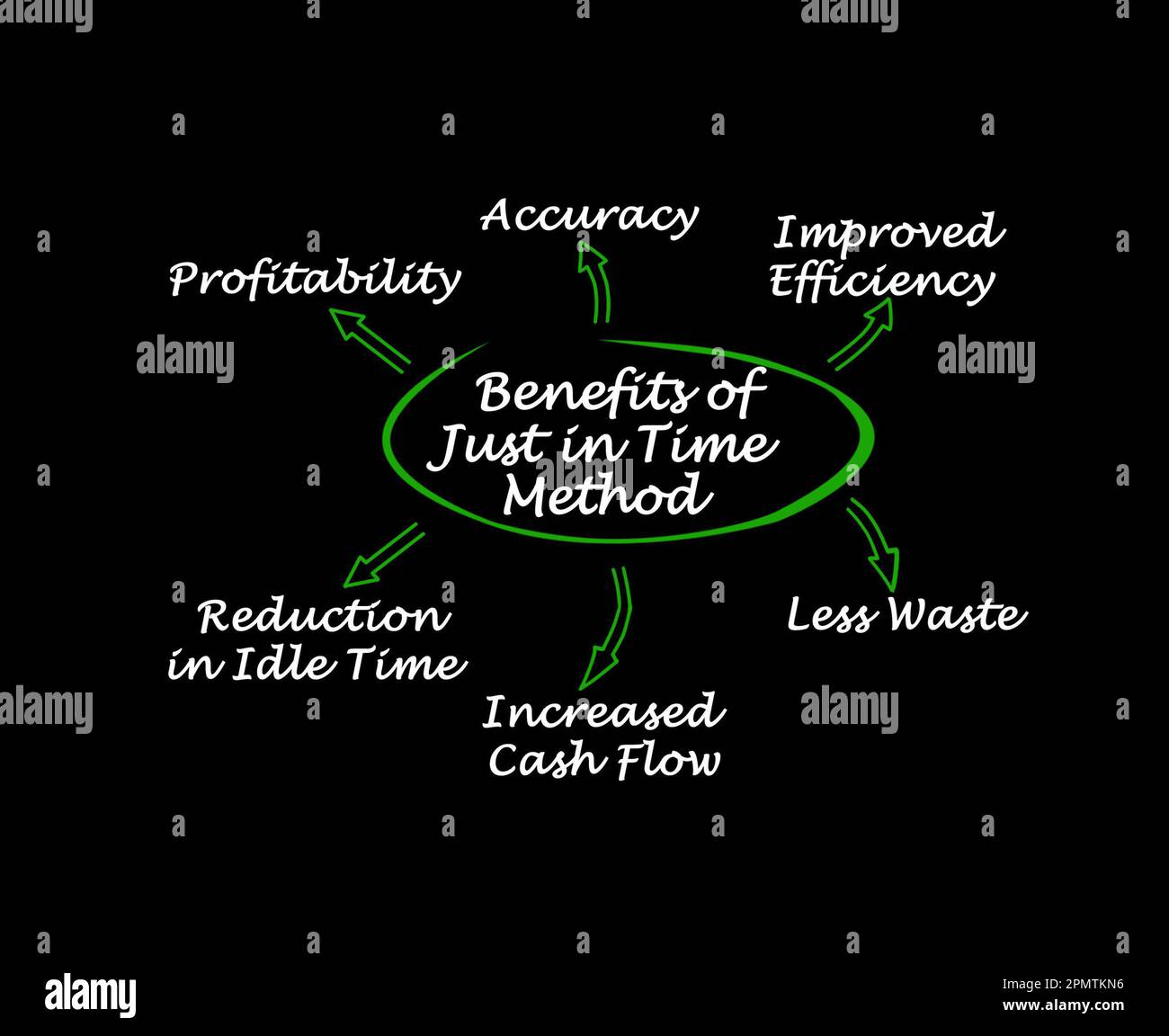

Companies referred to this extra inventory as safety stock and it forced them to manage this excess inventory and absorb a dent in their profits. Just-in-time (or JIT) is an inventory management method in which you keep as little inventory on hand as possible. That means you don’t stockpile products and raw materials just in case you need them—you simply reorder products to replace those you’ve already sold. However, newer companies with budget constraints and a lack of federal tax credits for consumer energy efficiency storage space may also choose to use JIT, because it allows them to place smaller orders and free up cash flow. If your company has low inventory, small batch sizes, or a non-complex supply chain, JIT could still be a good fit for you—as long as you can find reliable suppliers. JIT aligns production schedules and fulfillment processes with the delivery of supplies for a continuous flow of work, and focuses on reducing the amount of time between receiving and delivery.

Even smaller retailers can take advantage of the JIT method to streamline the delivery process. For example, a company that markets office furniture but does not manufacture it may order the furniture from the manufacturer only when a customer makes a purchase. Led by Mohammad Ali (15+ years in inventory management software), the Cash Flow Inventory Content Team empowers SMBs with clear financial strategies.

- Also known as short-cycle manufacturing, JIT aims to produce exactly what, when, and how much was ordered – either by the next workstation sequence or the customer.

- JIT emphasizes quality control and defect prevention to reduce the occurrence of defects, improving overall efficiency and customer satisfaction.

- JIT is widely used in industries such as automotive manufacturing, electronics, and consumer goods, and has been credited with improving productivity, reducing waste, and enhancing customer satisfaction.

- If you’re using JIT, you won’t need much storage space for completed goods or materials.

- Because you only order when a consumer puts an order, your item is already sold by the time it reaches you, eliminating the need to have your things on hand for an extended period of time.

Nike also implemented a real-time inventory management system, which allowed the company to quickly respond to changes in customer demand. Harley-Davidson also implemented a “pull” system, which means that products are produced only when they are needed. JIT inventory management requires significant investment in training, process improvement, and technology. This can be challenging for small or medium-sized businesses that may not have the resources to implement JIT inventory management fully. JIT inventory management requires efficient transportation and logistics to ensure that products are delivered on time.

Cassie is a former deputy editor who collaborated with teams around the world while living in the beautiful hills of Kentucky. Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager. The lack of parts being supplied caused Toyota, a company that relied on them, to have to halt production for several weeks, ultimately costing them over $1 billion in revenue. For example, Toyota, which was one of the earliest companies to adopt this strategy in 1970, may only order car parts from suppliers when they have an order for cars to be produced. In a JIT system, companies keep on hand only materials that will be immediately used for the production of goods. This caused a ripple effect, where other Toyota parts suppliers likewise had to temporarily shut down because the automaker had no need for their parts during that time period.

But if you order smaller numbers of items at a time, you enjoy greater agility to abandon products that are no longer selling well. Of course, JIT inventory systems fall apart without prompt, reliable item production and shipping. But once you get it down, JIT systems can enhance the efficiency and profitability of your business.